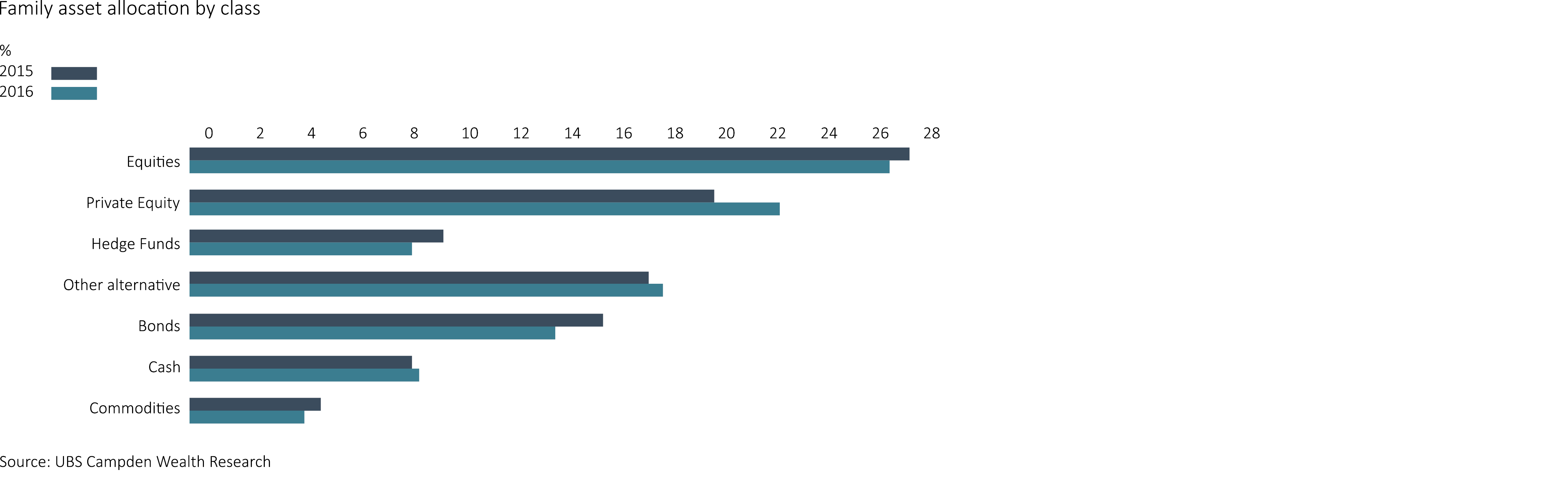

For the third year running UBS/Campden Wealth have published their Global Family Office Report. This report is formed from “quantitative only surveys of 242 family offices conducted between February and May” as well as interviews with “another 25 principals, executives and advisers”. The rise of private equity was a strong theme in both the 2014 and 2015 reports, with reports claiming 2015 the ‘Year of Private Equity’ – this trend has continued and strengthened in the last 12 months. “Private equity investments have become even more central to family offices over the past year and now represent close to a quarter of the average overall portfolio”, the 2016 report advises.

The report also states: “Private equity and real estate once again outperformed most other asset classes…” This should alleviate any doubts over private equity’s current performance as an asset class in general.

The report noted that “family offices are playing to their strengths by allocating more to longer-term opportunities and accepting more illiquidity”. Many believe that this approach can be successful when there are experienced in-house teams, who have sufficient bandwidth to complete due diligence, whilst also managing existing private equity investments.

In Australia, family offices and sophisticated investors continue to seek out opportunities directly and, in AUS Finance Group’s experience, they are also looking for introductions to off-market opportunities and investments in non-bank products.

How can we help?

Opportunity – One of the most difficult aspects of private equity investment is finding appropriate investment opportunities. AUS Finance Group source a range of diverse opportunities – including joint venture projects, mezzanine finance, construction & development funding, deposit funding and senior debt, which we present to our investor group. You decide which risk/return opportunities are the right type of investments for you.

Experienced Staff – AUS Finance Group prides itself on hiring the best in field, subject matter experts and having a strong network of strategic partners to enhance our offering. You benefit from having priority access to a best-in-industry client services team providing a coordinated approach to maximising your investment opportunities.

Joint Ventures –In dealing with many sophisticated investors including family offices, AUS Finance Group has noted one very important thing, there is nothing better than sharing ideas and doing business with like-minded people, in a private, confidential environment. We partner in projects to combine the essential skill set for successful development projects.

Due Diligence process – In our experience not all family offices have the capacity to complete adequate due diligence on projects or investments, so opportunities are missed. AUS Finance Group has a comprehensive Due Diligence process as well as a dedicated Product Investment Committee, comprising of both internal staff and independent third party members, with extensive experience in the property market and funds management sector. Key decisions are never made by just one person and all aspects of the market and a project are taken into careful consideration before being offered to prospective investors.

Transparency – All investment opportunities are presented to you in a clear and concise manner, setting out the investment advantages and risks, making your decision an easy one.

Like to find out more?

If you’re a sophisticated investor and one or more of the above points resonate with you, why not pick up the phone and speak to our Head of Investment Services, Chris Broad on 0407 096 237 or cbroad@ausfinancegroup.com.au.

For more information regarding sophisticated/wholesale investors visit the ASIC Website .

Lauren Said, Manager – Marketing and Communications.

Learn more about Lauren.

Disclaimer: This article has been prepared without taking into account your objectives, financial situation or needs and should be regarded as general advice only. Before acting on this advice you should consider whether it is appropriate for your needs and has regard for your own objectives and financial situation. We encourage you to consult a finance professional before acting on any advice provided in this article or found on this website.