Investors face a constant battle when managing cash. Do I want the highest interest rate? Do I want my funds at-call? Do I want the security of top tier banks? Too often, these choices are seen as mutually exclusive, where one comes at the expense of another.

When dealing with significant sums of capital or longer periods of time, usually over $100,000 and longer than 3-4 months, the battle is further exacerbated as headline/promotional rates often do not apply.

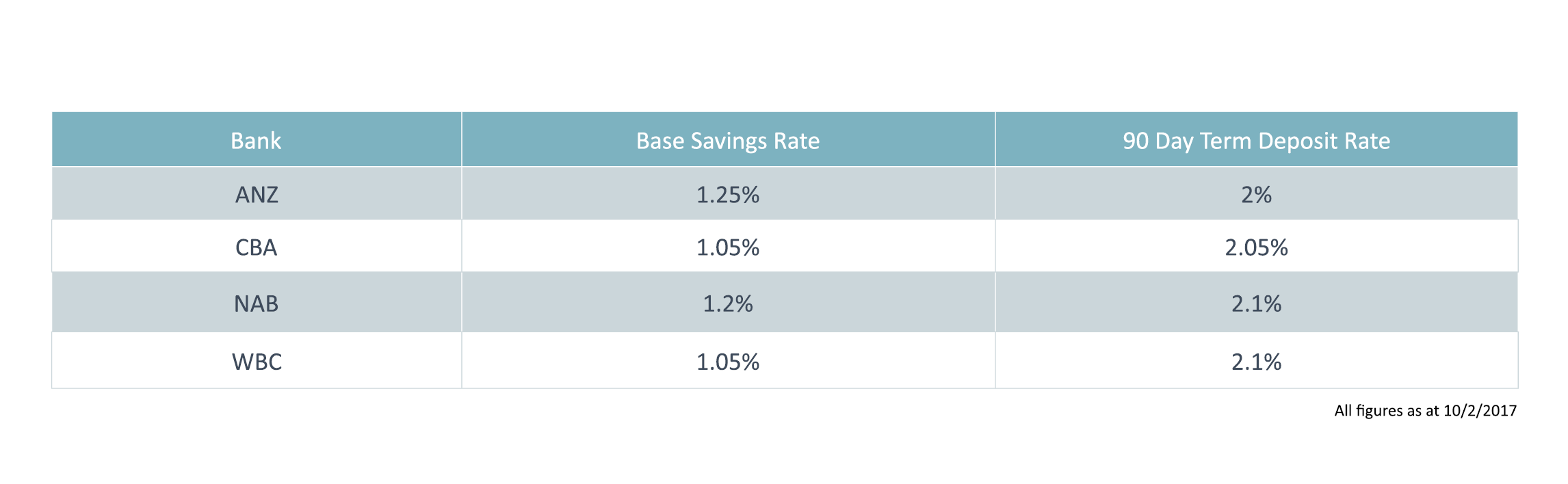

A quick check of the current base interest rates offered by the big 4 banks shows the trade-off clearly, between savings accounts which are liquid, and term deposits which are not: As expected, term deposits offer an illiquidity premium, meaning investors need to choose whether they are prepared to sacrifice access to their cash for a higher return. Higher rates may also be accessed by moving to lower tier banks, which may be riskier from a capital structure perspective and/or more involved to transact with.

As expected, term deposits offer an illiquidity premium, meaning investors need to choose whether they are prepared to sacrifice access to their cash for a higher return. Higher rates may also be accessed by moving to lower tier banks, which may be riskier from a capital structure perspective and/or more involved to transact with.

The true cost of illiquidity arises because of the ‘optionality’ of cash, a concept tied to a branch of financial instruments called real options (to be discussed in a later article). When capital is locked up, this optionality (i.e. ability to purchase/invest) is temporarily eliminated and sound investment opportunities may be missed because of an inability to raise liquid funds. Hence, there’s an implicit potential opportunity cost to locking up cash. Financial and academic luminaries such as billionaire investor Warren Buffett and author of ‘The Black Swan’ Nasim Taleb often discuss this concept in their texts.

With this in mind, prudent investors understand the need to maintain some cash holdings in their portfolio, but to maintain their ability to act, may think lower at-call rates are most suitable.

Is this the case? Not necessarily.

Cash Management Funds (CMFs) which invest in a range of bank term deposits of varying maturities can offer interest rates comparable to term deposits, but have liquidity periods of a week or less, due to rolling maturities and active liquidity management. Thus, instead of sacrificing optionality for 3 months, 6 months, 12 months or longer, investors can ‘have their cake and eat it too’, achieving rates far superior to at-call savings accounts, without losing flexibility. A subset of CMFs also restricts term deposit investment to the Big 4 banks, so investment risk is very, very small and remains as ‘true’ cash.

The win-win aspect of this class of Funds is precisely the reason AUS Finance Group now offers our own Cash Management Fund, which is currently running a gross yield of 2.42% p.a. and has 7-day liquidity.

There’s no need for this battle to end in a trade off – why not have both?!

For more information, please contact our Head of Investment Services, Chris Broad on 0407 096 237 or cbroad@ausfinancegroup.com.au .

Stuart Luelf, Senior Manager – Property and Investment Services

Learn more about Stuart.

Disclaimer: This article has been prepared without taking into account your objectives, financial situation or needs and should be regarded as general advice only. Before acting on this advice you should consider whether it is appropriate for your needs and has regard for your own objectives and financial situation. We encourage you to consult a finance professional before acting on any advice provided in this article or found on this website.